Can I Change My Car Loan Term Malaysia

Get your car valued. While a variable rate car loan has interest and instalment amount that fluctuates along with the prevailing Base Lending Rate BLR.

What To Do After You Pay Off Your Car Loan Part Time Money

If there is no lock-in period you can settle your loan any time you prefer without paying an early settlement fee.

. That loan amount is up 12 from the same period in 2020. Even for lock-in periods. The average loan term in the fourth quarter of 2021 was almost 70 months with an average interest rate of 386.

Interest rate 64 24 4. It could be a good idea to build up a clean credit history. Call Maybank Group Call Centre at 1-300-88-6688 for general inquiries on the announced reduction.

Use this calculator to determine 1 how extra payments can change the term of your loan or 2 how much additional you must pay each month if you want to reduce your loan term by a certain amount of time in months. The buyer simply pays the agreed amount to the seller. The Terms.

If youll be getting a replacement car new or used its fairly easy to trade in a car with a loan outstanding. You can also use this as a standard auto loan calculator by simply entering 0 in the. Remaining loan amount after the first 10 years RM361549.

Select LoanFinancing Select Vehicle LoanHire Purchase Enter AccNo. Or Vehicle no Enter Amount Select the Account you wish to make payment from Confirmation screen displayed Transaction completed CDM. And just like the personal loan the shorter the term the higher the monthly repayment and vice versa.

Lets say you sell your car and the buyer agrees to pay for the vehicle in cash the entire process is so much easier. Its the next-easiest way to go if you cant pay off the loan first. Hence having a shorter tenure will allow the borrower to pay off their loan sooner.

Based on a margin above the Banks Base Lending Rate BLR Based on fixed interest rate per annum flat. Most car loans are fixed at 36 48 60 or 72 months. For instance if you take a loan of Rs 8 lakh with an interest rate.

The only thing you need to remember when settling your loan during the lock-in period is that youll need to pay the fee the early settlement fee stated in your loan agreement. Monthly repayment RM2191. Get a finance settlement figure.

Next comes a simple Puspakom B5 Ownership Transfer inspection then to the nearest Road Transport Department branch to transfer the ownership of said vehicle and the keys are. Check with the bank directly or use a prepayment calculated to arrive at the exact amount. Malaysias OPR has been changed several times in recent years with the latest change coming on 7th July 2020.

Opt for a smaller loan if you can afford it. This cut the OPR rate to 175 the lowest rate on record. Financing isnt as critical to most used-car buyers.

Calculate the total repayment amount along with the penalty charges for pre-closure. Try different loan scenarios for affordability or payoff. DSR helps to determine whether or not you can afford to service your loan monthly.

Create amortization schedules for the new term and payments. Based on fixed interest rate per annum flat. Firstly youll need to get a finance settlement figure from your lender and ensure the V5 certificate is in your name.

Having no credit record makes banks uncertain of your ability to pay. The step by step procedure in the pre-closure process can be given as follows. Statistics show that nearly 61 of fourth-quarter 2021 used car sales were cash transactions.

A poor credit score is not the only reason lenders reject loan applications. Gather all the proper documents required for prepaying the loan amount. All you need to do is enter your registration.

If you want to shorten your loan by a certain length of time and want to know how much extra youd have to pay every month to do so use the slider to adjust the additional monthly payment figure until the blue field at the top shows the length of time you want to shorten your loan term by. One of the most simplest loans in Malaysia a basic term loan follows a fixed repayment schedule with a monthly instalment that remains the same. Amount of each instalment or the number of instalments shall be revised whenever there is a BLR revision.

Then your car needs valuing which is super simple with our Sell Your Car tool. In Malaysia most car loans are the fixed rate variant. How do I change my car before the end of my finance agreement.

Select CDM Select Cash Payment Select Maybank Cash Payment Select LoanFinancing Select Vehicle LoanHire Purchase. From the above you can see that refinancing with the new housing loan saves you RM116 every month or a total of RM27840 in interest savings. The interest on a fixed rate car loan does not fluctuate and it features an unchanging instalment amount throughout the entire repayment period.

We Pit A 5 Year Old Myvi Mercedes Benz C Class Honda Civic Toyota Vios And Mini Cooper Against Each Other The Winner Honda Civic Toyota Vios Toyota Innova

How Do I Qualify For A Car Loan Experian

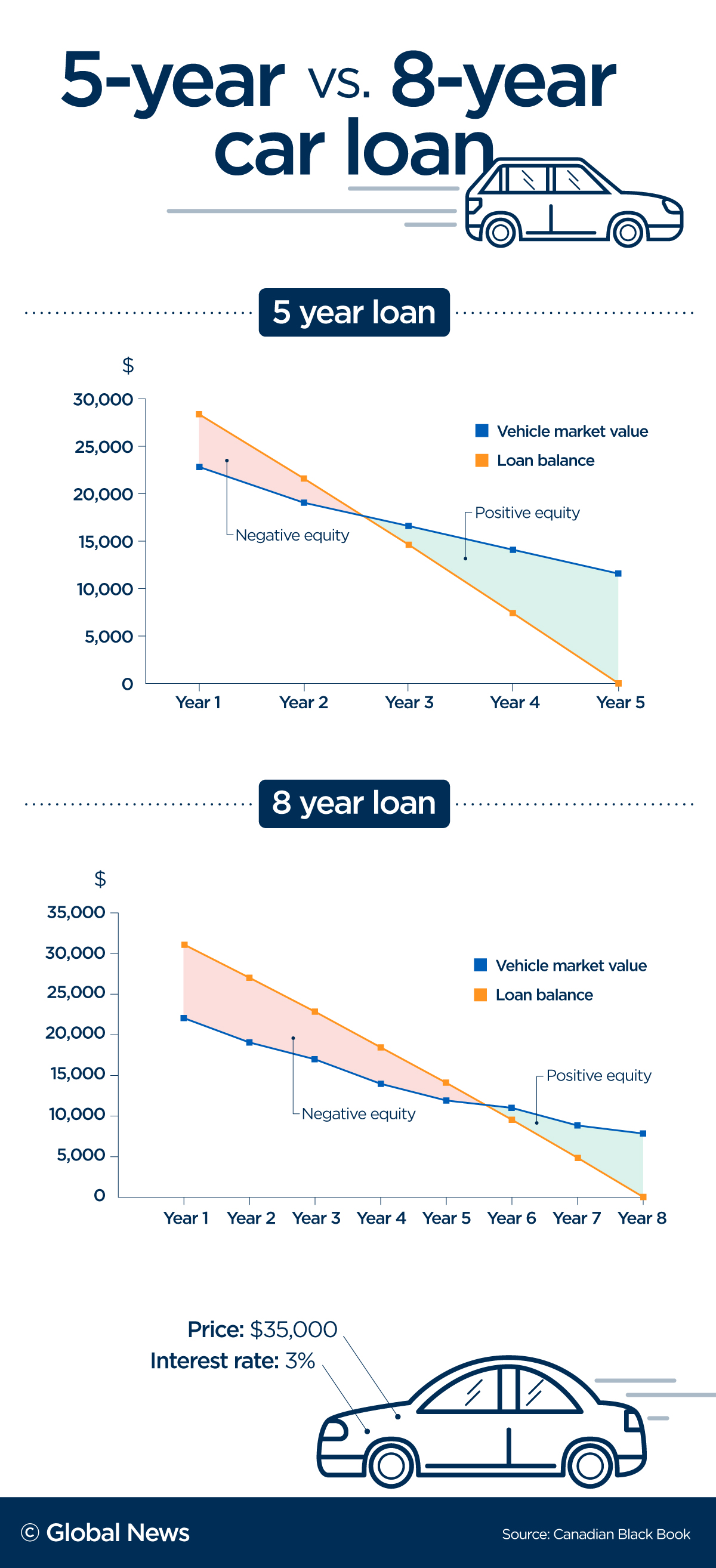

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca

What Is The Safest Form Of Payment When Selling A Car Sell My Car In Chicago

Here S What Happens When Your Car Is Repossessed And Your Options

Handling Your Car Loan When You Lose Your Job

0 Response to "Can I Change My Car Loan Term Malaysia"

Post a Comment